It has been good to own Scheffler stock this year.

Getty Images

There’s a fun corner of the Official World Golf Ranking website, where you can view interactive charts of where Tour players have been ranked, week by week, through the years. You can even pit the ranking of two players against each other to look back and see when a player’s form dipped, when they made a rise, etc.

It didn’t dawn on me until last December that those OWGR charts look an awful lot like stock charts, the kind you see all over the internet of performance on the New York Stock Exchange. It suddenly made sense that, at some level, we are seeing a player’s position rise, fall, plateau or peak week after week, as though they’re stocks being traded. After all, their ranking is dictated by a points average and an algorithm based on the number of events they play and how they perform in this events. It is, essentially, a golf market full of businesses moving up and down based on performance.

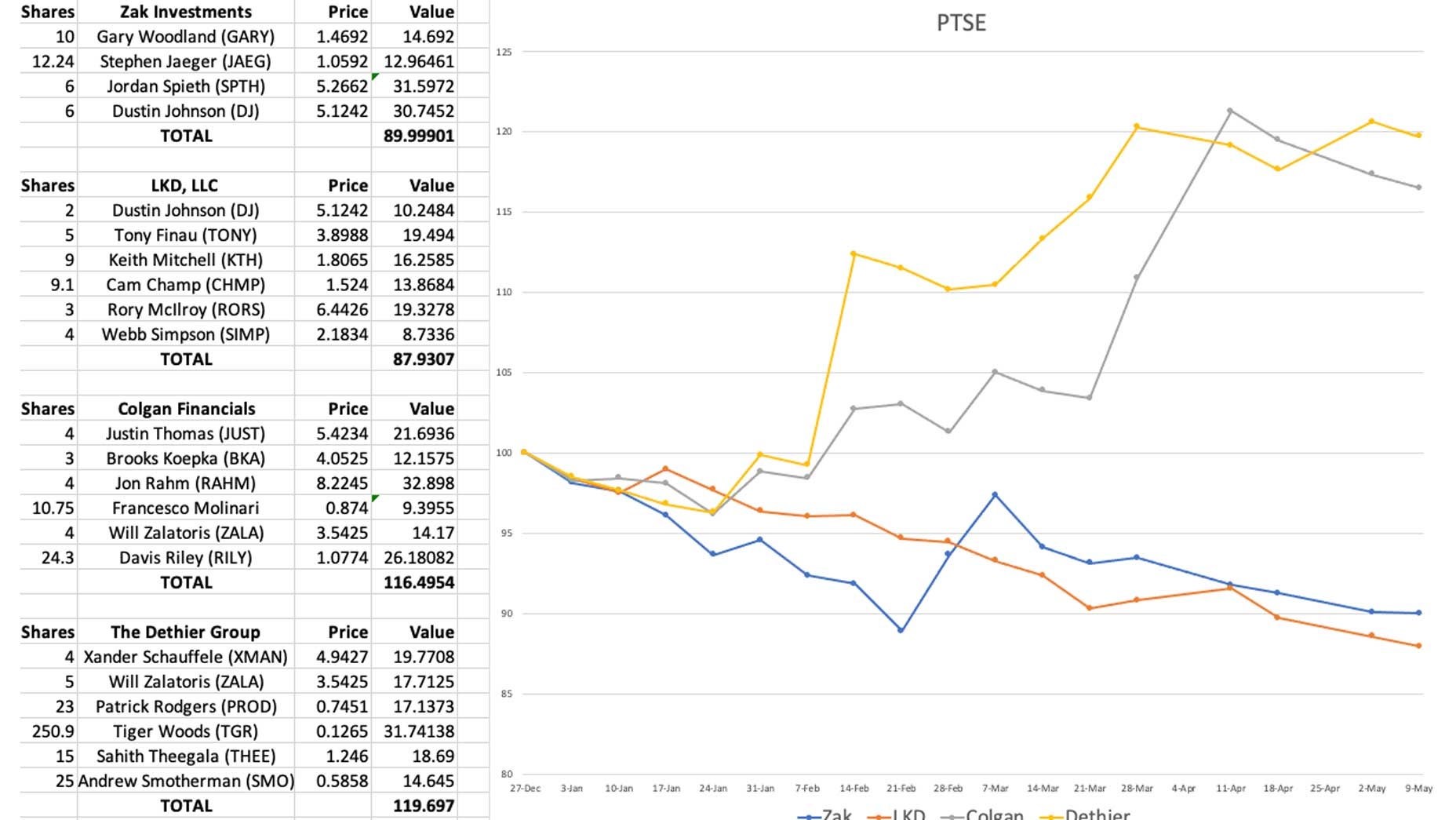

And so, like any good podcast host hungry for a new segment would do, we made a game out of it. It’s called PGA Tour Stock Exchange (PTSE) and we’ve been playing it all year on the Drop Zone Podcast. Feel free to share with us what stock prices we’re sleeping on.

Is Dustin Johnson a good buy right now, at just $5.12 a share? I certainly think so. How about Tiger Woods at just $0.12 a share? Dylan Dethier has directed his savings account trust in Tiger’s corner. The Wells Fargo Championship marked the end of Q2 in this fantasy world, so we provided listeners an update of how we’re balancing our portfolios in this week’s episode of the show. Right now, Dethier’s team is crushing it, thanks mostly to Sahith Theegala and Martin Trainer. Below you’ll find our current holdings, their prices and how each team has performed thus far this year.

Notable stock performances in Q2:

SIMP (Webb Simpson): -25.93%

Luke Kerr-Dineen made a gamble diving in on Simpson’s stock at the beginning of Q2 and it didn’t pay off. As a result LKD, LLC is deep in the red and struggling to find a way out of it. His big move for Q3? 9.1 shares of Cameron Champ at just $1.524 a share.

TRNR (Martin Trainer): 48.64%

Dylan Dethier proudly held onto stock of his favorite golfer, Martin Trainer, throughout all of Q1 and Q2. One of the cheaper stocks with full Tour status, Trainer’s price increased by nearly 50% thanks to a T7 in Puntacana and a T11 at the Mexico Open. The gamble by Dethier paid off, and he spent all his earnings on TGR stock. That’s right, Tiger Woods. The man who might not play more than one event in Q3. Dethier now owns 251 shares of TGR stock, desperate for a made cut next week at Southern Hills.

BKA (Brooks Koepka): -7.34%

The entire suite of portfolios believed in Koepka in Q2, but no one more than myself, who owned six shares. We figured it was major championship season, and that Koepka would do what he does best: contend in majors. Well, his missed cut at the Masters was brutal for everyone, and his not playing again throughout the end of Q2 zapped any positive gains he made at the WGC-Match Play. It was a 7.34% loss for all Koepka holdings, which isn’t getting any better this week with his WD from the Byron Nelson. Both Zak Investments and LKD LLC backed out of their Koepka stocks and placed them elsewhere. I bought up six shares of DJ stock and six of Spieth stock instead.

CHEF (Scottie Scheffler): 37.39%

To absolutely no surprise Scheffler stock delivered in a big way during Q2, delivering 37.39% gains for Colgan Financials. Scheffler began the year at a stock price of $5.079 and Colgan sold off his holdings of CHEF at $9.7513 for a whopping 92% profit. No stock has been so fruitful this year, and Colgan Financials has benefitted as a result, sitting in second place in our fantasy competition. His answer to all that profit was to sell CHEF and buy back in to a major-championship worthy stock: RAHM.

If you’d like to hear more about how we’re balancing our PGA Tour Stock Exchange portfolios, check out the podcast in this link or in the player below.