The PGA Tour, the Saudi Arabian-owned Public Investment Fund and LIV Golf may be working to finalize the terms of their planned merger, but it won’t take place without a closer look from Capitol Hill.

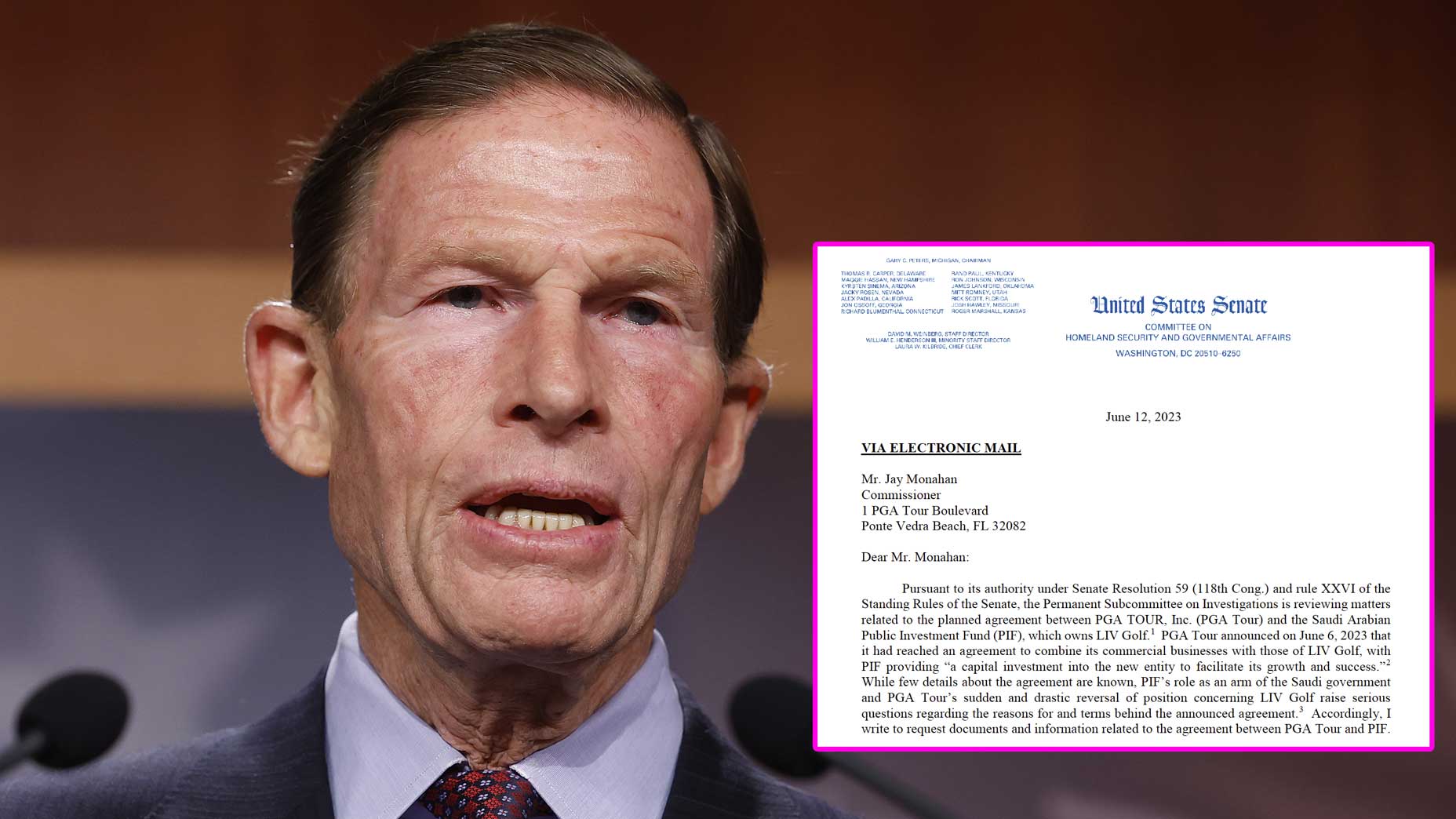

Sen. Richard Blumenthal (D-Conn.), chairman of the Senate Permanent Subcommittee on Investigations, said Monday the deal raises concerns “about the Saudi government’s role in influencing this effort and the risks posed by a foreign government entity assuming control over a cherished American institution.”

Blumenthal sent letters to both the PGA Tour and LIV Golf seeking records and emails about how the deal was reached and how the newly formed entity will be structured and operated.

After an initial media release last week by the Tour that called it a merger, both parties have tried to avoid characterizing the deal as a merger, saying the PGA Tour would retain its non-profit status and the joint commercial entity would exist as a secondary asset. The press release by the PIF announcing the news June 6, and still available on the organization’s website, starts with the statement that the “PGA Tour, DP World Tour, LIV Golf merge commercial operations under common ownership.”

However, LIV Golf and several golfers sued the PGA Tour last year for alleged antitrust violations, calling it a monopoly throughout their 118-page complaint. The U.S. Department of Justice had also been looking into possible anticompetitive practices of the PGA Tour after the Tour tried to punish some of its players for joining LIV.

By combining forces, the PGA Tour and LIV Golf could become an even bigger target for antitrust regulators, who could potentially try to block or delay the deal.

Citing Saudi Arabia’s “deeply disturbing human rights record at home and abroad,” Blumenthal said in his letter to PGA Tour commissioner Jay Monahan the Tour’s “sudden and drastic reversal of position concerning LIV Golf raise serious questions regarding the reasons for and terms behind the announced agreement.”

Contributing: Brent Schotenboer, Nancy Armour