Pebble Beach, one of the greatest golf properties in the world.

Getty Images

Some would say that only Mother Nature can claim Pebble Beach as her own, but the development along Northern California’s stunning stretch of coastline represents more than 100 years of multimillion-dollar wheeling and dealing.

THE ORIGINAL BIG FOUR (1880)

Through their Pacific Improvement Company (PIC), railroad tycoons Charles Crocker, Mark Hopkins, Collis Huntington and Leeland Stanford open the Hotel Del Monte, followed soon after by 17-Mile Drive and Del Monte Golf Club.

THE DUKE OF DEL MONTE (1915)

PIC hires Samuel F.B. Morse to liquidate its land holdings. The next year, Morse convinces them to build another course near Stillwater Cove that would become Pebble Beach Golf Links.

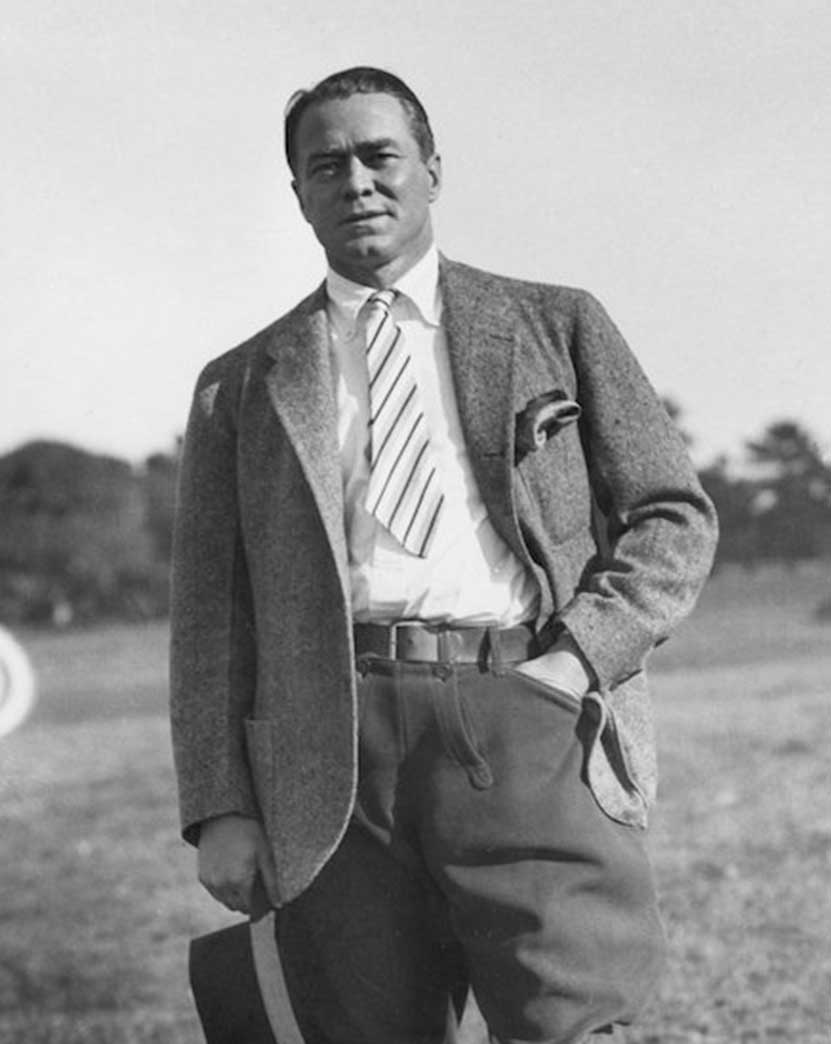

Samuel F.B. Morse

Getty Images

PEBBLE AND BEYOND (1919)

Morse forms the Del Monte Properties Company and, for $1.34 million, acquires all of PIC’s holdings. He goes on to have a hand in developing Cypress Point, Monterey Peninsula CC and Spyglass Hill, among other area courses. He’s the peninsula’s main developer for the next 50 years.

MAY THE COURSE BE WITH YOU (1977)

Del Monte Properties Company reincorporates as the Pebble Beach Corporation and, a year later, is acquired by 20th Century Fox for $81.5 million, using profits from its Star Wars success. Fox reorganizes and renames it the Pebble Beach Company.

THE WILDCATTER (1981)

Big-time oilman (and, apparently, big Diana Ross fan) Marvin Davis, with moneyman Marc Rich, buys 20th Century Fox — including the Pebble Beach Company — for $722 million. A few years later, Davis sells his stake in the film studio to Rupert Murdoch for $325 million, but he retains PBC.

PACIFIC OVERTURES (1990)

Japanese businessman Minuro Isutani, owner of Ben Hogan Properties, buys Pebble Beach Company from Davis for $841 million. He almost immediately runs into financial trouble.

FIRE SALE (1992)

Two years later, Isutani takes a bath when he sells the company to Japanese-owned Taiheiyo Golf Club Inc./Lone Cypress Company for $500 million.

Clint Eastwood

Allstar/Warner Bros.

THE NEW BIG FOUR (1999)

A group that includes Clint Eastwood, Peter Ueberroth and Arnold Palmer buys PBC for $820 million. They offer select investors minority shares at $2 million each. The value of those shares was recently estimated at $8 to $9 million. PBC itself? Worth between $3.2 and $3.7 billion.